Many of us who own one or multiple credit cards and use it regularly or even irregularly for that matter do not realize the mistakes we end up making which adversely affects our credit score eventually.

Nobody wants that impulsive shopping spree you carried out on your credit card to eventually come back and haunt you when you apply for a home loan due to an abysmal credit score which you never kept a track of.

Here are some mistakes many of us tend to make when we use a credit card and how to avoid them.

1. Using your Credit Card for Cash Withdrawals:

Many people view a credit card as basically a debit card used to borrow money from the bank. This can be very damaging as using your debit card does not affect your ability to take out a loan whereas a credit card can have a giant load of repercussions. As a result, many people, especially ones who do not really handle finances regularly, end up withdrawing cash from the ATM using a credit card. This can be a very costly affair as every time you withdraw money from an ATM using a credit card, a ‘Cash Advance Fee’ is charged ranging from 2.5-3% in many countries. Also, unlike regular credit card transactions, for cash withdrawals, there’s no interest-free period which means that the interest charges start from the day of the transaction till it’s paid in full. Many companies also levy interest rates on a per day basis for credit card cash withdrawals so it’s always best to avoid cash transactions using credit cards generally.

2. Paying only the Minimum Amount Due:

Many people think that paying only the minimum amount due would prevent incurring of financial charges even if the due date passes but that is not true. The only thing you can avoid by paying the minimum amount due is the late fee payment.Basically, what happens when you only pay the minimum amount is the finance charges is incurred on the outstanding amount.

For example, let’s say the annual interest rate is 24% on the credit card which means the monthly interest rate would be 2%. If you use your credit card for a $110 purchase, then after the interest-free period you will be charged 2% per month. If you pay the minimum amount due let’s say $10 in this case, then you will still incur financial charges or $2 per month (2% of $100) or $24 for the entire year.

The best thing to do is always pay off your credit card debt in whole during the interest-free period or by the payment due date.

3. Maxing out the Credit Limit on your Card:

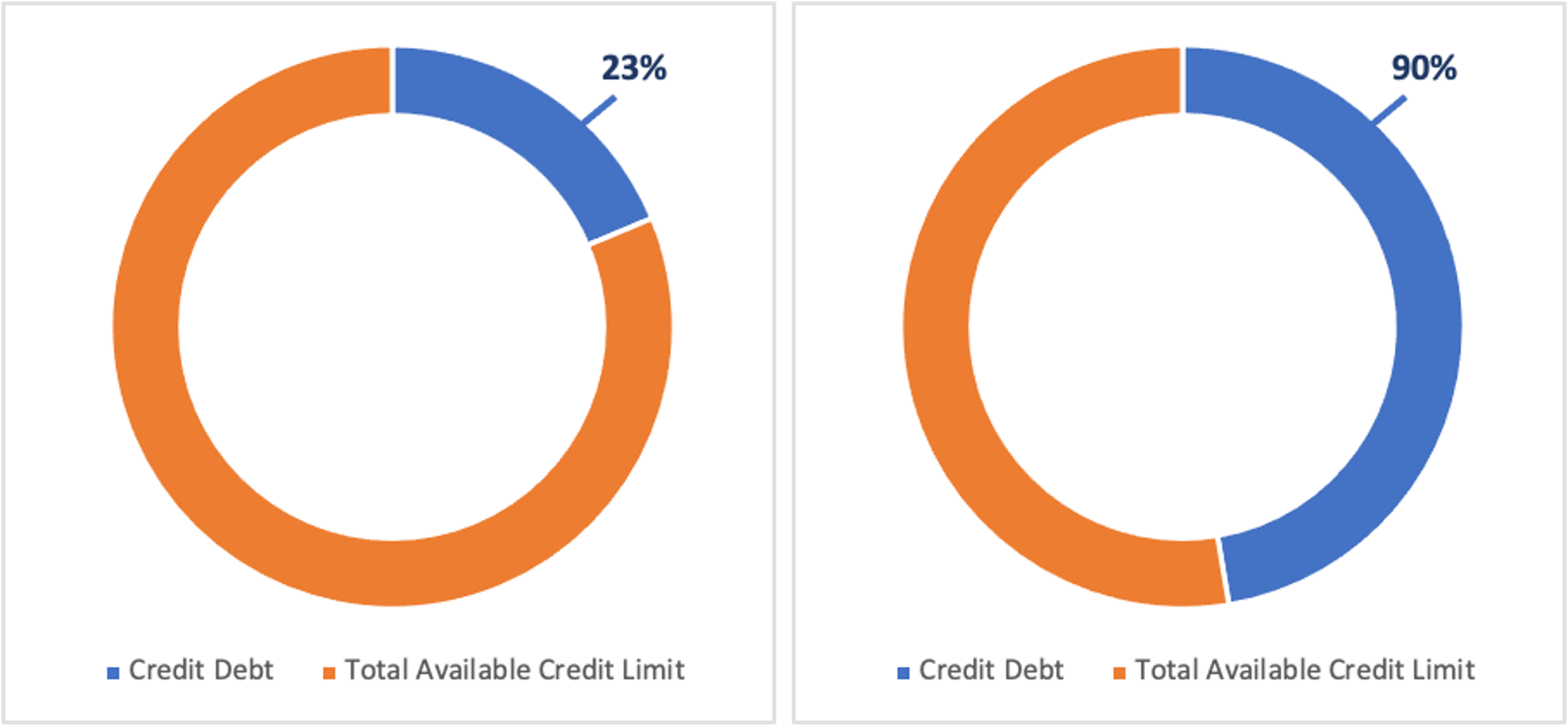

Many people tend to either use their credit card till the last penny or even overshoot the limit of the credit card. This causes your Credit Card Utilization Rate to soar a very high level which can affect your credit score as the it can impact 30% of a credit score making it one of the most important components to monitor to maintain a decent credit score.

So for example, if your credit limit on your credit card is $10,000 and you have made a transaction of $2,300, your Credit Utilization Rate will be 23% and it you make a transaction of $ 9000, your Credit Utilization Rate will be 90% affecting your credit score in turn much more than the first transaction.

It is recommended to keep your Credit Utilization Rate below 30% to make sure your credit score is not affected.

4. Not Paying the Annual Fee Associated with Your Card:

Most banks have an annual card fee that they charge every year even if you do not use your credit card which many people do not realize exists. This is seen more among people who do not regularly use credit cards or check their credit card statements. Although the fee is not high, if a person ignores this charge for a large period of time, they can incur interest charges on the fee, and it could also impact their credit score.

5. Using, Owning or Applying for Multiple Credit Cards at Once:

Many people apply too frequently for new credit cards and use multiple of these cards at the same time.

Firstly,applying for many credit cards in a short period of time could not only affect your credit score but also result in more rejections eventually when you apply for more of these credit cards or other kinds of loans from the bank as it would cause suspicion due to the sudden need of money which the lenders would assume is because you are in desperate need of funds due to wealth mismanagement and also have the inability to pay off the debts that you take on.

Secondly,owning and using multiple credit cards at the same time can also increase your chances of defaulting payments as keeping a check with multiple card payments at the same time could be tiresome and have more scope of being overlooked. Also,the habit of depending on your credit card for normal expense is a dangerous cycle to get into as essentially taking debt for even the smallest spending can result in one taking on more debt as they are not able to cut their expenses according to their dime and even push them into a debt trap.

6. Getting Charged-off of Your Credit Card:

A charge-off on your card takes place when you do not pay your credit card debt for months in which case your creditor/bank, closes the account as a bad debt and the outstanding amount left is recorded as a loss for the creditor. This does not mean that you have escaped paying your loans as by the time this takes place, it has damaged your credit score significantly essentially debilitating you to take on another loan in the near future. Also, many creditors sell your debt for peanuts to collection agencies or debt buyers who now, much less civil and accommodating than your creditor, start harassing you with calls and regular visits. It is one of the worst things to happen both for your ability to take up another loan and also for your peace of mind as in most cases, the harassment cannot even be reported to authorities as the victim of the harassment is also the defaulter in this case.

7. Not Utilizing Your Credit Card Rewards:

Almost all credit cards come with benefits and reward points on purchases made on these cards which last between 2-3 years. Many people do not avail the benefits of this in time even though the rewards are significantly beneficial with upgrades or miles being added for your air travel, free hotel stays, movies etc. being available to redeem. Instead of swiping your credit card for that movie you were going to go to, check your reward schemes as it may actually be free thus avoiding spending. Many cards also give cash backs which also in turn could help with some of your expenses, but it’s important to also not overindulge in using your credit solely to reap reward benefits.

8. Closing Your Card Randomly and not Properly:

Many people think that the solution to avoid damaging your credit score is to completely close your credit card account, but it is not necessarily true. The average amount of time you have had credit also affects your credit score and hence when you close your account, this average changes. Let’s say you have an active credit card for 7 years and another for 2 years and close the 7-year-old card, the average amount of time you have had credit changes from 4.5 years((7+2)/2 = 9/2) to just 2 years and affecting your credit score accordingly.

Additionally,if you have let’s say a high outstanding amount on the 2-year-old card of $1000, then your credit utilization score also increases as now the denominator(the total debt available) reduces due to the closure of the other card.

If you do intend, to close a credit card though to control let’s say your spending issues, it’s recommended to close the newer card instead but it’s also important to check the credit or debt taken from other cards as well. It’s always good to close the card after taking consulting better sources and ensuring that your credit score is not affected as a result.

——————————-

Univesco advises future global industry leaders on their most critical issues; strategy, information technology, sustainability, corporate finance, across all industries and regions. Our approach towards our clients is that we believe in “Results”. Among Univesco’s global clients, they love working with start-ups as by assisting them in their growth journey, they feel they have also accomplished somewhat.

Rishi is our kudosbay’s professional business finance expert with a hedge fund background and a graduate from London business school.