If you’re an entrepreneur, you probably have asked yourself this question more than once. In fact, that’s the number 1 most important question my clients ask me. As an investor myself investing at the seed-stage in multiple Venture Capital funds,I focus on investments where I ask myself the question as to why I’m the right investor for this start-up? As much as I would want my answer to be plain black and white to my clients or rather myself, unfortunately the world doesn’t work this way.

Securing a seed investment is a significant turning point for start-ups.

Start-ups must develop a product prototype if required, test market assumptions and so on so forth. Considering the circumstances, convincing an experienced investor that you have the grit, tenacity, and talent to bring an idea to market is no small feat.

As the overall economy and specifically the tech industry is maturing, there is a robust amount of capital deep rooted in the pockets of the investors, fuelled by the boom in the techsector on a global macro economic level. This has assisted many start-ups to become leaders of their industry at a rapid pace.

1. Realistically, are you venture scale?

-

20x return: simply put you need to create a value of this scale or something higher. Can you turn £10 to £100? If yes, Well Done! If no, consider this question “why should an investor trust you to be able to turn £1 Million to £100 Million”?

-

Velocity: the rate of change of your position with respect to a frame of reference. Velocity is equivalent to your speed and direction of motion. Heading in the right direction and at the right speed with your start-up? If no, go back and analyse.

Simply put, if you arenot of a scalable scale, and you’re raising money — or spending — like you are,there is a problem. Burning other people’s cash won’t necessarily help you andmost definitely not the investors.

2. How competitive are you?

As a founder, you have to be laser-focused on solving the challenges directly in front of you. “Be first, be smart or get out”. Be grounded but you can’t afford to be complacent.

· Winners take all: Assuming that your start-up is successful and that you’re tackling a valuable market opportunity,2–4 direct, formidable competitors will likely arise in your space. UBER vs LYFT vs GRAB seems familiar to anyone?

· Have a broader horizon: Maintain a long-term perspective. If you can’t provide projected future growth and earnings potential, as an Investor “I don’t want to talk to you”.

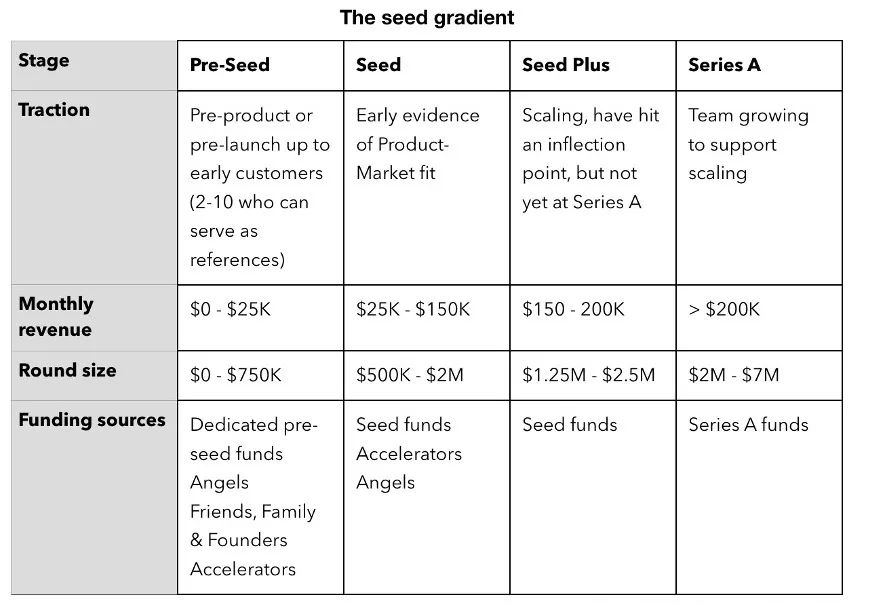

3. Where are you on the seed gradient?

4. Are you willing to adapt to changing circumstances?

As you build a network of VC firms, evaluate the potential of each and select a lead investor. Prioritize those that align with your core mission, values, and purpose. If someone isn’t showing that kind of interest, de-prioritize. Generally speaking, there are two types of investors: Those who are hands-off and those who take a keen interest in your company. However, handle criticism in a constructive manner and build from the experience.

——————————-

Univesco advises future global industry leaders on their most critical issues; strategy, information technology, sustainability, corporate finance, across all industries and regions. Our approach towards our clients is that we believe in “Results”. Among Univesco’s global clients, they love working with start-ups as by assisting them in their growth journey, they feel they have also accomplished somewhat.